The current shift is seeing non-traditional search platforms becoming an entry point for search, as opposed to supplementary layer to validate initial consideration.

In this article, we will understand the changing patterns displayed by consumers because of economic and behavioural influences, as well as exploring how technological developments are shifting the way we use the channel, and what the future of search is shaping up to look like.

.png/?)

Key trends influencing search marketing in APAC

- Search journeys are becoming shorter – “same day delivery” searches in the APAC region have risen over 215% since pre-pandemic levels.

- Sale-based activities continue to thrive in search: “promo”-related searches were 16% higher in 2022 compared to 2019.

- APAC’s Gen Z audience is increasingly turning to TikTok user-generated content to satisfy their search-based requirements.

Why it matters

Users asking platforms for “how to” or “what to buy” content isn’t new – we’ve seen this trend for years on YouTube. However, the current shift is seeing non-traditional search platforms becoming an entry point for search, as opposed to supplementary layer to validate initial consideration.

The digital world, as well as its audience, continues to evolve, and search must continue to adapt to remain a dominant feature. Whilst many questions remain around what exactly this future will look like, what we do know is that AI will play a key role in shaping it, and what does remain is the demand behind the intent.

An age-old saying, “the customer is always right,” still guides what we see here; giving consumers what they want, when they want it, and in a format that they want it, remains the north star in the evolution process that we are witnessing unfold.

Takeaways

- Consumers are looking for the best value for money. This is a far more aggressive economic landscape, especially for online retailers: three in four Aussies claim they are not brand loyal, according to a Sitecore report based on brand authenticity.

- The rising proportion of AI-based search functionality in market is prompting further questions around transparency of placement and targeting performance.

- Content will become even more crucial for brands as systems like ChatGPT crawl for relevant responses to user prompts.

Global and local factors create a distinct difference in how certain markets respond to behavioural and economic triggers – something that became very apparent as we grappled with the COVID-19 pandemic in recent years.

This differentiation also plays a role in how markets lean into new technologies and is something we’re seeing play out particularly within the search advertising landscape.

In this article, we will understand the changing patterns displayed by consumers because of economic and behavioural influences, as well as exploring how technological developments are shifting the way we use the channel, and what the future of search is shaping up to look like.

Consumer trends

As we experience economic volatility across the globe, the impact to retailers, and subsequent consumer demand is taking many forms. A long line of interest rate rises in markets like Australia have led to increased scrutiny on advertiser ROIs and a keen eye on marketing cost inflation, whilst the recent influx of technological developments including the much talked about ChatGPT are subsequently keeping the appetite for testing very alive.

APAC advertisers are still braced for further escalation of cost-of-living challenges, so testing is expected to be considered, controlled, and conclusive – and of course, beneficial to performance KPIs. From a consumer standpoint, economic considerations are prompting APAC consumers to slow down – with 2022 trends showcasing this in the form of less travel (-10%PP), less dining out (-8%pp), less going out (-5%pp), and less attendance at less live events (-4% pp), according to GWI data.

How we are seeing this translate into commerce behaviours, is that consumers shop around and prioritise attributes like price points more highly as part of their shopping experience; hence we are seeing a strong sense of competition around price, as well as triggers such as free delivery and service levels becoming ever more important.

Ultimately, consumers are looking for the best value for their money, and with consumer sentiment seeing declines, we’re seeing a far more aggressive landscape – especially for online retailers, with three in four Aussies claiming they are not brand loyal.

Consumer journeys

With all this considered, the way consumer journeys are adapting as a result is becoming more apparent. Consumers are expecting more relevant and more immediate answers to their questions – the rise of natural language models and elements like voice search even further escalating this, as users expect to see a response specifically tailored to their search, based on who they are, even faster than before.

Search journeys are becoming shorter – in fact, “same day delivery” searches in the APAC region have risen over 215% since pre-pandemic levels. More readily available product comparison, and audience-focused optimisation strategies refining targeting capabilities, is further reducing the path to purchase by better aligning search results to specific users. This is bolstered further with more consumer-ready search additions like click and collect options and “local inventory ads” helping to answer the demands of consumers wanting speed and convenience.

Similarly, sale-based activities are continuing to thrive – with record breaking numbers experiences in peak retail season last year (Black Friday – Christmas) and search trends seeing +16% growth in “promo” related searches last year compared to 2019 (pre-pandemic).

Emerging audiences

58% of our APAC market is now Gen Z, and what we’re learning from these emerging audiences is that they do not resonate well with traditional cluttered ad environments, with nine out of 10 Gen Z in APAC having customised their privacy options to reflect this insight.

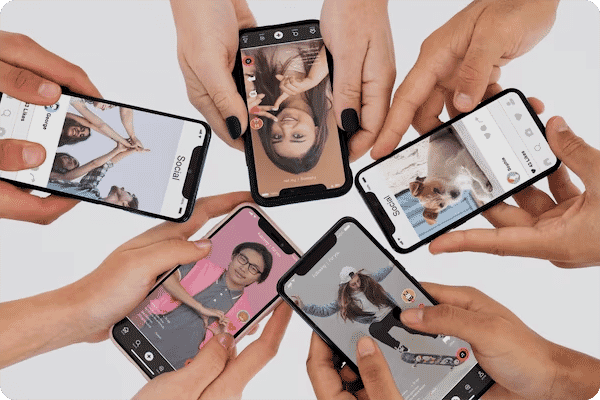

As a result, we’re starting to see a shift in the type of platforms users are searching with – TikTok being a key example here, as younger demographics in particular turn to platforms leveraging user generated content to answer their demands.

This can be looking for a recommendation for somewhere to visit, or product reviews. TikTok has, of course, tapped into this trend to trial search functions within their platform to monetise this behaviour.

Asking platforms for “how to” or “what to buy” isn’t necessarily new – we’ve seen this trend for years across the likes of YouTube – but this shift sees more of a market grab from traditional search by becoming the entry point for user demand, opposed to being used as a supplementary part of the user journey to validate the consideration layer.

Privacy

Privacy is a key consideration (and expectation) in APAC markets across all audiences, not just isolated to emerging generations. Whilst regulatory changes have been live on a global scale for some time, with GDPR and CPPA all well-embedded within protocols, we are still working through this process now in APAC markets like Australia, where only recently the Attorney General proposed reforms to the Privacy Act of 1988.

Similarly, countries in APAC more widely rank among the lowest globally when it comes to internet privacy. What this has meant from an advertising perspective is that APAC consumers have displayed the highest willingness to exchange personal data for free services compared with the rest of the world – with GWI’s Q3 report last year finding 41% of APAC consumers are willing to trade PII.

That said, consumer awareness is rising around the topic, triggering a call for more to be done around protection of personal data. Whilst APAC may be slower to act, there is still change afoot. And, of course, the impending deprecation of cookies remains a talking point, as advertisers try to get their head around what this means for the future of addressability. Google this week launched its latest ‘Ads Transparency Center’ tool, following up from ‘My Ad Centre’, which launched in October last year, enabling more control over the ad experience users see online.

Search product development

AI is leading the charge in APAC, as it is globally, with what seems like a continuous stream of new feature launches – mostly focused on the idea of maximising publisher inventory with more visual formats, to deliver the desired campaign outcome.

The search itself has evolved greatly over the past few years – with intensifying AI and functionality such as natural language models enhancing search results pages, all geared up to give the user what they want, when they want it. These advancements have led to shifts in advertiser sentiment around previously roadblocked tactics – such as the use of broad match – as new product iterations designed to work in conjunction with automated bidding methods and broader inventory scaling (think Performance Max), start to become the norm.

This is not just limited to Google. We are also seeing a lot of product pushes within the Microsoft Ads search suite – recently changing network options to automatically opt users in to the MSAN network (Microsoft Audience Network), as well as removing the Broad Match Modifier option, following Google’s move to do the same in 2021.

The rising proportion of AI-based search functionality in market is prompting further questions around transparency of placement and targeting performance – with the offset of these new methods being the loss of campaign granularity, and direct control, advertisers have on their search campaigns – and the increasingly blurred lines as to what is classed as a search campaign – given Performance Max’s entrance to the market.

In addition to developments we’re seeing from Google, Microsoft Ads recently updated its platform targeting to opt users into the MSAN (Microsoft Audience Network) as standard, and removed its “search partners only” setting in favour for “Microsoft Sites and Select Traffic” which incorporates sites that are deemed to perform similarly to Bing.

Inflation and costs

After what seemed like an initial bubble of acceptance around the loss of campaign granularity since automation was more widely introduced into search optimisation, we are a trend of advertisers starting to question search costs in APAC.

The initial love affair with smart bidding meant many advertisers didn’t question specifics such as the cost of branded traffic, as they were seeing overarching business results offset the need to scrutinise at such a granular level.

Whilst results are still very strong, the focus on ROI is prompting questions around inflation when it comes to paid search metrics.

The future of search

As many start to integrate the use of generative AI tools within their day-to-day; testing different use cases to improve efficiency outputs, the benefits should always be weighed against the risk – with potential misalignment to brand guidelines as well as use from a legal and compliance perspective, should all be key considerations.

Questions around what the future of what the actual search results page will look like are commonly cropping up, with brand safety and quality assurance when it comes to content misinformation being key considerations.

What we expect to see is that content will become even more crucial for brands as systems like ChatGPT crawl for relevant responses to user prompts, and as we see these tools further evolve, we will inevitably see a change in the way search is displayed, and the actual positioning of ad units within a user’s response.

From an organic search perspective, the impact of generative AI tools is starting to shift the way brands optimise their own website and content strategies – for example, looking to how they build the use of FAQs to answer consumer demand versus how this stacks up against search volumes.

Battle of the tech giants

From a search market share perspective, the big question on everyone’s lips is whether Microsoft can claim back some market share from Google’s dominance. In the medium term we expect Google is safe. For the longer term, that really depends on the next moves we see from both Google and Microsoft.

Microsoft is investing very heavily in its infrastructure when it comes to AI – as well bolstering inventory and audience capabilities through recent acquisitions of Xandr and Activision Blizzard, LinkedIn audience integration, and, of course, the Netflix partnership. And, when the “new” ChatGPT-infused Bing was announced, with early access available as a value exchange to download the Bing App to get a sneak peak, understandably new users to the platform surged – reaching over 100 million. However, this still only scratches the surface comparatively to Google’s one billion-plus daily users.

Microsoft has been on the front foot with a lot of solid product news of late. With Google’s rush to launch its own version of AI (BARD) causing some embarrassment in testing scenarios, it does offer Microsoft an opportunity to widen the gap it has with ChatGPT currently – though, not for very long, as the latest iteration of BARD has literally been announced recently for testing expressions of interest.

Whether this will translate to long term market share still relies on the ad product itself though, and whether this can translate into the scale and efficiency the Google Ads platform has been contributing for advertisers – and additionally how much more aggressive we see Google respond with their own AI capabilities.

In summary

The digital world, as well as its audience, continues to evolve, and search must continue to adapt to remain a dominant feature. Whilst many questions remain around what exactly this future will look like, what we do know is that AI will play a key role in shaping it, and what does remain is the demand behind the intent.

An age-old saying, “the customer is always right,” still guides what we see here; giving consumers what they want, when they want it, and in a format that they want it, remains the north star in the evolution process that we are witnessing unfold.

Georgina Wall is the GM of Product & Partnerships at Resolution Digital, and responsible for driving group process and output across the Resolution Digital’s activation team; which encompasses all biddable media – Programmatic, SEM, and Paid Social.

Originally published on: B&T

.jpg?w=375&cw=375&ch=450)

.svg)

.svg)